Exploring Low Tax Countries for Cryptocurrency Earnings

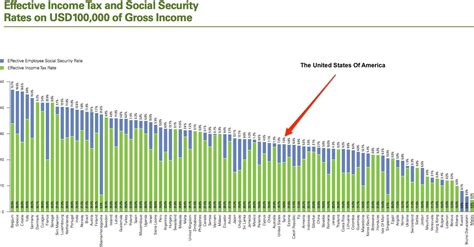

As the popularity of cryptocurrencies continues to grow, investors are looking for safe havens and low-tax jurisdictions where they can potentially earn significant profits. While the tax implications of cryptocurrency investments are complex and multifaceted, several countries have been identified as attractive options due to their relatively low tax rates.

Why Low Tax Countries Matter

Tax laws play a significant role in determining an investor’s financial decisions. When it comes to cryptocurrencies, high taxes can erode returns, reduce investment returns, and increase the overall cost of investing. By choosing low-tax countries for cryptocurrency investments, investors can minimize their tax obligations, maximize their gains, and enjoy a higher return on their investment.

Best Low Tax Countries for Crypto Investors

Here are some of the countries with the lowest tax rates for cryptocurrencies, ranked by their current tax regimes:

- Bahrain: Bahrain offers a 0% tax rate on foreign-source income, including capital gains from cryptocurrency investments.

- Cyprus: Cyprus has a flat income tax rate of 20%, but also offers a reduced rate of up to 15% for certain types of investment income, such as dividends and interest.

- Ireland: Ireland has a 12.5% corporate tax rate on foreign-source income, including capital gains from cryptocurrency investments.

- Singapore

: Singapore has a flat income tax rate of 2%, but also offers a range of deductions and allowances for investment income, including dividends and interest.

- Switzerland: Switzerland has a top marginal tax rate of up to 30% on foreign-source income, including capital gains from cryptocurrency investments.

Tax Benefits in Low-Tax Countries

In addition to low taxes, other benefits may include:

- No Withholding Tax: Some countries do not charge withholding taxes on dividends and interest earned by non-resident investors.

- Deductions for Investment Expenses: Many countries offer deductions or credits for investment expenses related to cryptocurrency investments, such as trading commissions and management fees.

- Access to tax-free investment regimes: Some countries have established tax-free investment regimes for specific types of investments, including cryptocurrencies.

Challenges and considerations

While low-tax countries can be attractive to cryptocurrency investors, there are several challenges and considerations to keep in mind:

- Regulatory risks: Cryptocurrency regulations are still evolving and may change rapidly, which may impact investor confidence and investment returns.

- Exchange fees: Many online exchanges charge high fees for trading cryptocurrencies, which may impact returns.

- Security risks

: Cryptocurrency investments are subject to security risks, including cyber attacks and hacking.

Conclusion

Investing in low-tax countries to earn cryptocurrency income requires careful consideration of tax implications, regulatory risks, exchange fees, and security concerns. By doing the proper research and choosing the right jurisdiction, investors can minimize their tax obligations and maximize their investment returns.

Recommendations

If you are considering investing in low-tax countries for cryptocurrency, here are some tips:

- Learn about the specific tax laws and regulations that apply to your investment.

- Consult with a financial advisor or tax professional to ensure compliance with local regulations.

- Consider diversifying your portfolio by investing in multiple jurisdictions to minimize risk.

- Maintain records and documentation of your investments and transactions.