Navigate in the complex world of cryptocurrency: a guide for cryptographic explorers, portfolio diversification and exchange

The world of cryptocurrency has driven a long way since its beginning in 2009. From the initial exaggeration of Bitcoin to the wide range of today’s old coins and assets based on today’s blockchain, the space continues to develop. A decisive aspect of navigating this complex panorama is to find the suitable instruments for diversifying the portfolio and risk management. In this article we will examine three key components: Cryptography Explorers, strategies for diversification of portfolio diversifies and exchange that meet these requirements.

Cryptography Explorers: The spine of cryptocurrency research

A crypto Explorer is a tool with which users can discover, analyze and visualize the wide range of blockchain assets. These explorers often contain characteristics such as:

* Block Chain Mapping : Detailed representations of the underlying blockchain architecture, with which users can identify potential weaknesses and optimize their investments.

* Intelligent contract analysis

: Smart Contract test, which are self-execution programs that automate specific transactions or processes in a blockchain network.

* Market data : market data in real time, with which users can remain informed about price movements, commercial volumes and other relevant indicators.

The popular cryptographic explorers include:

- [Coinmarketcap] (

- [Blockfi Explorer] (

- [Cryptoslate] (

Portfolio diversification strategies: risk and reward balance

The diversification of the portfolio is a crucial aspect of risk management in the cryptocurrency area. By spreading investments in several types of assets, users can reduce their dependence on individual investments and reduce possible losses.

Some strategies for diversification of portfolio diversifies must be taken into account here:

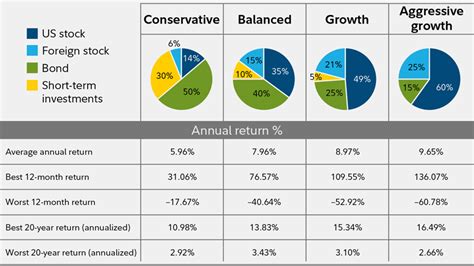

* Asset assignment : Allocation of part of your portfolio in various types of assets such as actions, bonds or cryptocurrencies.

* Average costs in dollars : Invest a fixed amount of money at regular intervals, regardless of the market conditions to reduce the effects of volatility.

* Cover

: Use of derivatives or other strategies to compensate for potential losses in a class of assets with profits in another.

Some popular portfolio diversification tools include:

- [Investopepedia portfolio diversification tool] (

- [Coinmarketcap Cryptcap Crypto Divergenence Tool (

- [Cryptoslate Cryptoslate Crypto portfolio diversification] (

Exchange: a platform for buying, selling and acting from cryptocurrencies **

A stock exchange is a digital platform with which users can buy, sell and exchange cryptocurrencies. Excavations offer an efficient and safe way to access the cryptocurrency market.

Here are some important properties of the exchange:

* Types of orders : Users can give up different types of orders such as market orders, limited orders, detention orders and more.

* Safety : Exchange generally offer solid security measures to protect user money and to avoid piracy.

* Liquidity : Exchange often have a high level of liquidity, which makes it easier for users to buy and sell cryptocurrencies at affordable prices.

The popular stock exchanges include:

- [Coinbase] (

- [Binance] (

- [Kraken] (

Finally, navigating in the complex world of cryptocurrency requires a combination of tools, strategies and knowledge. By using cryptographic explorers, portfolio and exchange diversification strategies, users can effectively manage the risk and maximize their potential yields in this area in rapid development.