“Market of Crypto of Puente Taverwater”

As the panorama of cryptocurrencies develops even more, it is essential to understand the complexity of the market and how different components work together. In this article, there are two key concepts that are often misunderstood or ignore: liquidity protocols (LPS) and Aptos (APT) and their role in facilitation of cold bridges.

Liquidity protocols (LPS)

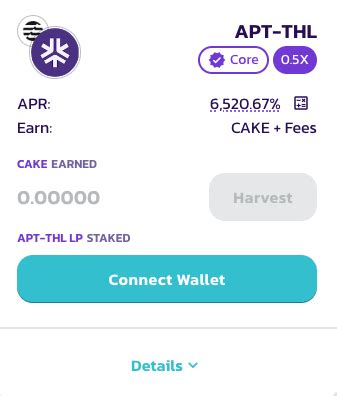

Liquidation protocols (LPS) play a decisive role in the cryptocurrency market, especially during volatility and market stress. LP is a protocol that allows merchants to “close” their coins in exchange for liquidity tokens, which can be used to buy or sell assets in another stock market.

In traditional markets, merchants can easily turn their cryptocurrencies into fiduciary coins with reputation. However, this process often implies a slide and significant rates that can make the gains of the marginal merchant worse. LPS is the issue of providing a decentralized platform for merchants to ensure it in the currencies, reducing the risk of prices and increasing market efficiency.

For example, some exchanges of values offer LP services that allow users to close coins and gain interest in their bets. This provides coverage against market recessions, allowing merchants to maintain a stable gain rate, even if the markets are volatile.

Aptos (Aptos)

Aptos is a new cryptocurrency project aimed at creating a decentralized chain bridge of the Ethereum Network. Apt was launched in 2021 and since then has been attracted to its unique technology and potential use.

The suitable protocol allows users to transfer devices between several blockchain networks such as Ethereum, Polkad and Solana, without worrying about charges or gas costs. This service is particularly valuable for decentralized financial applications (Defi) that depend on chain interactions.

One of the most important features is to admit two -layer two -dimensional solutions, providing an attractive opportunity for developers at the upper Ethereum. In addition, Aptos has a robust test and a growing developer who is happy to contribute to the development of the project.

Cross Lchain Bridge

The Cross Cross bridge is a critical element to facilitate the transfer of devices between several blockchain networks. Cross Chain Bridges allows users to store their devices in a block chain while accessing them on another network, often with lower rates and a faster execution time.

In relation to suitable, the protocol provides a decentralized bridge for the Ethereum Network, which allows users to transfer devices in block chains without relying on centralized or medium -term securities bags. This service has significant consequences for applications that depend on chain interactions, such as liquidity groups, chips and management.

The Appetos Crucade Chain Bridge is built on the top of the Binance Smart Smart Platform (BSC) and admits multicapa scale solutions. The bridge uses a new consensus algorithm that allows rapid and safe transactions through several networks through several networks Blockchain.

Conclusion

In summary, they are essential elements of the liquidation protocols (LPS) in the management of market risk and facilitate the interactions between chain labels within the cryptocurrency ecosystem. Aptos (APT), on the other hand, is a significant advance in decentralization and scalability, which offers a robust solution for defi applications that depend on chain interactions.

The combination of the suitable liquidity protocol and the Cross Cross Bridge has long -range consequences for the broader cryptocurrency market, which allows users to store their devices in a block chain while they still access them in another network.