Double Whammy of Short Positions and Price Activities in Decentralized Finance

Decentralized Finance (Defi) Has Been Gaining Popularity in The Last Few Years Thanks to The Innovative Models, The Latest Technology and the Developing Community. However, Defi also has a number of risks, including short positions that can have destructive consequences. In this article, we will examine the concept of short positions, price activities and their potential threats in Defi.

What is a short position?

A short item is an investment strategy in which you borrow a certain amount of assets (e.g. tokens, cryptocurrencies) with the expectations of their redemption at a loos price later. If the price drops, you can sell your borred assets to make a profit. However, If the Price Increases Intead, You Will Remain Wormthless Or SeriOutly Underrated Assets.

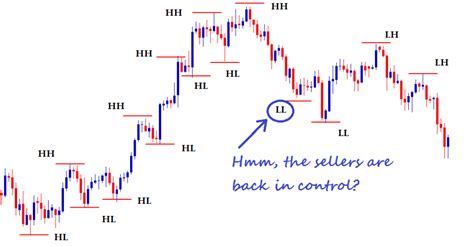

Price activities in Defi

Price Activities Relate to the Fluctuations in Assets in Time. In Defs, Price Activities are Often by Market Moods, Regulatory Changes and Other External Factors. For Example:

* Pump and Dump Diagrams : Price Increase can be coordinated with Pump Schemes and drops in which the individual or group artificial overstates the price of the token to sell it upstairs, Leaving Investors significant losses.

* Market Manipulation : Regulatory Authorities Can Try to Manipulate Market Prices By Buying or Selling Assets in a Way That Creates Artificial Trends. This can lead to price variability and instability.

Risk of short positions in Defi

Short Positions Are Partularly Dangerous in Defi Due to the Following Risk:

* Risk of liquidity : if the value of the borrow assets decreases, you can fight for selling it with profit, which leads to significant losses.

* Risk of Contractors

: Contractors Involved in Short Positions May Fail Or Become Insolvent, Exposing Investors to Potential Obligations.

* Market Variability : Short Positions Can Strengthen Price Movements, Making Them More Unstable and Unpredictable.

Price and Short Positions

Price Actions May Exacerbate the Risk of a Short Position by:

* Strengthening Price Movements : Price Increase May Make It Difficult to Make Profits in its Short Position.

* Creating Market Moods : Pump and Dump Diagrams or Market Manipulation can cause false trust, Increasing prices, even if the underlying assets do not reach well.

Soothing Risk: best practices

To minimize the risk when using defi platforms:

- Do Thorough Tests : Understand the Platform, its Basic Technology and Any Potential Risk.

- Use Margin Protection

: Use Margin Protection Mechanisms to Limit Losses in the Case of Significant Price Fluctuations.

- DIVERSIFY Your Investments : Spread Your Investments Into Many Assets to Reduce Relying On One Token Or Assets.

4.

Application

Decentralized finances sacrifice Investors Exciting possibilities, but it is important to be aware of the risk associated with short positions and price activities. Understanding Thesis Concepts and Taking Into Account the Best Practices, You Can Minimize The Exposure to Potential Losses and Certainly Navigate the Defi World.