“Crypto Strength Index for Relative Gains: RSI and Market Cap Boosters: A Guide to Understanding the ICO Landscape”

The world of cryptocurrency is a high-risk, high-reward arena where investors must constantly adapt to changing market conditions. The Crypto Strength Index (CSI) provides insight into the relative strength or weakness of various cryptocurrency markets. In this article, we will delve deeper into the CSI, examine how it is calculated, and discuss its significance in the context of initial coin offerings (ICOs).

What is the Crypto Strength Index?

The Crypto Strength Index is a technical analysis tool that measures the market capitalization of different cryptocurrencies based on their relative strength compared to the overall cryptocurrency market. It is also known as the Relative Strength Index, or RSI for short. The CSI is an alternative way to gauge market sentiment and identify potential buy signals.

How is the Cryptocurrency Strength Index calculated?

The CSI is calculated using a combination of two indicators: the Price-to-Valuation Ratio (PVR) and the Price-to-Market Capitalization Ratio (PMRC). PVR measures the relationship between a cryptocurrency’s price and its valuation, while PMRC measures the relationship between a cryptocurrency’s market capitalization and its total value.

The CSI is calculated as follows:

CSI = 100 – [(1 / Price-to-Valuation Ratio) + (Price-to-Market Capitalization Ratio)]

For example, if a cryptocurrency’s PVR is 2.5 and PMRC is 3.4, the CSI would be:

CSI = 100 – [((1 / 2.5)) + ((1 / 3.4))] = 98.35

Relative Strength Index (RSI)

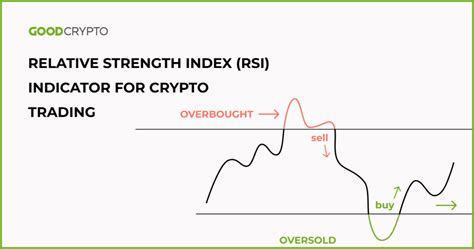

The RSI is another popular technical indicator that measures market momentum and potential overbought or oversold conditions. It is calculated using the moving average of the cryptocurrency price, and an exponential smoothing factor (EMA) is used to determine the signal line.

There are two versions of RSI: 14-period and 28-period. The 14-period RSI is more commonly used because it provides a clearer indication of overbought or oversold conditions.

Market Cap (MC)

The market cap (MC) of a cryptocurrency shows its total value, based on the number of coins outstanding and their current prices.

The Importance of ICOs

ICOs are significant events in the cryptocurrency world, where new cryptocurrencies are created and distributed to investors. When considering an ICO, it is very important to analyze the market conditions before the project starts.

Here are some key points to consider:

- Market Cap Boosters: ICOs often experience a boost in market capitalization due to high investor interest.

- RSI and CSI: The RSI and CSI can provide insights into potential buy signals for new cryptocurrencies. A bullish RSI reading with low CSI values may indicate a potential buy opportunity, while a bearish RSI reading with high CSI values may signal a sell opportunity.

- PVR and PMRC: The PVR and PMRC indicators can also be used to gauge market sentiment and identify potential buy or sell signals.

Conclusion

The Crypto Strength Index (CSI) is an essential tool for investors and analysts who want to understand the relative strength or weakness of various cryptocurrency markets. By calculating the CSI using RSI and MC, you can gain valuable insights into market conditions leading up to an ICO. However, there are several indicators that are crucial to consider when making investment decisions.

Recommendations

- Use a combination of indicators: A comprehensive approach that includes different technical analysis tools can help you better understand the cryptocurrency market.

- Stay informed: Constantly monitor market trends and adjust your strategy accordingly.

- Diversify: Spread your investments across multiple cryptocurrencies to reduce risk.