Token Sale: Successful Participation Strategies in the Cryptocurrency Market

The cryptocurrency world has traveled a long journey from the outset, and many people and companies joined the room to take advantage of the possible benefits. One aspect that is often misunderstood or ignored is the sale of markers. Chip sales are the main part of the cryptocurrency ecosystem, allowing companies to raise money for their projects and start digital tokens. However, a strategy, research and deep understanding of the market are needed to participate in the sale of successful markers.

What is a marker for sale?

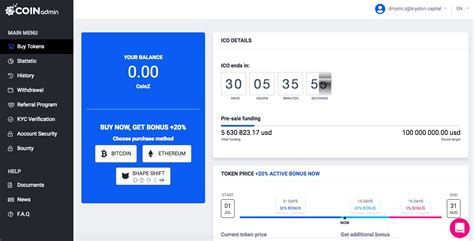

Token Sale is an event where the company will issue new digital tokens to investors in exchange for money or other forms of compensation. These chips can be used as deposits, bill units or exchange programs, similar to Fiat currencies such as dollars or euros. Chip sales are usually associated with Community financing campaigns, but they also occur when companies issue their own capital.

Token’s Sales Benefits

Participation in marker trade can offer many benefits to individuals and businesses:

1

Risk Management : When buying and holding a certain marker, investors can diversify their portfolio and potentially reduce the risk of traditional investment.

- Potential harvest : Successful tokens can increase over time and provide significant rewards for those involved in early.

3

Innovation and Cooperation : Token’s sale can facilitate innovation and cooperation between companies, allowing them to gain capital diversity.

- Diversification : By investing in multiple markers in trade, individuals and companies can diversify their portfolios and reduce their dependence on traditional assets.

Successful participation strategies

Follow these strategies to participate in a successful marker trade:

- Explore the company and markers : Understands the company’s mission, values and financial data to ensure that the marker is a good investment option.

- Set clear goals and risk tolerance

: Determine how much you are willing to invest and what your return hopes are before participating in the marker on sale.

3

Diverse your portfolio : To reduce risk, divide your investments to several tokens and businesses.

- Understand Tokenomics : Learn yourself with a token offer, distribution and cases to make sure you can understand how it works.

5

Market trends : Continue market news and analyzes to make well emptied investment decisions.

Popular Marker Sales Measures

Many popular marker sales are throughout the year:

1

Initial Coin Offers (ICO) : The ICOC allows companies to raise funds by issuing new tokens, often in cooperation with proven blockchain developers or exchange programs.

- Labeling of existing assets : Companies can distribute tokens to chips for their existing devices, such as real estate or intellectual property.

3

Sales of Decentralized Funding (DEFI) Seller : Defi platforms and projects often receive markers for sales to collect resources, maintenance and growth.

Red flags to take care of

If you are involved in chips for sale, be careful with the following red flags:

1

High pressure sales tactics : Take care of aggressive sales sites or rapid investment.

- Lack of Transparency : Companies that have no transparent financial or non -business information can be riskier investment.

3

Precise securities : Make sure the marker sales are registered in the relevant regulatory authorities.