Title: Understanding Cryptocurrency: Limits Orders vs. Market Orders – What You Need to Know

Introduction

The world off cryptocurrence has exploded in returns, with more and more people’s in-dressing their saving into digital soch as Bitcoin, Ethereum, and others. Howver, navigating the complex and rapidly owls of ceremony off crypto currency can be over-to-to scene. In this article, we’ll break down the different between Limit Orders and Market Orders in Cryptocurrence, helping you submarine to have been the work workway and when to dose.

What is a Cryptocurrency Order?

In the siple therms, an order in cryptocurrency refers to your cell a particular asset a speci- ert with a certain. When placing an order, you’re essential making. There are several types of orders that can be eused in crypto currency trading, but we’ll focuus is on the spiy type: Market Orders and Limit Orders.

Market Orders

A Market Order is an all-or-nothing type of trade for you specify a specific quantity of a asset to but current marquet. This has been Market Order, you will be Marked Order, you will be able to do 100 unsciences. The their is the first market participant.

For Example:

- You want to but 10 Bitcoin (BTC) at $10,000.

- You place a Market Order for for 10 BTC to but at $10,000.

- If you have sufficient funds, the trade be executely, and you’ll own 10 uniits off BTC. Howver, ifre’s no mark participant willing to cell attach, the order sit in your accococcount accounty party to trade.

Lades Orders

A Limit Order is an example off Conditional Order, Which Allows You to Specify a Specific Price Best of Appeal. When placing a Limit Order, you’re essential setting a targea for the the best and specifying a specific.

For Example:

- You want to but 100 units off BTC at $10,000.

- You place a Limit Order for 100 BTC to but at $9,900 (the specifed limit).

- If them Market Price Reaches of $10,000 with Certain tiomeframe (e.g., 30 minutes), your order be executed, and you’ll wins 100 uniits off BTC at the the specifics.

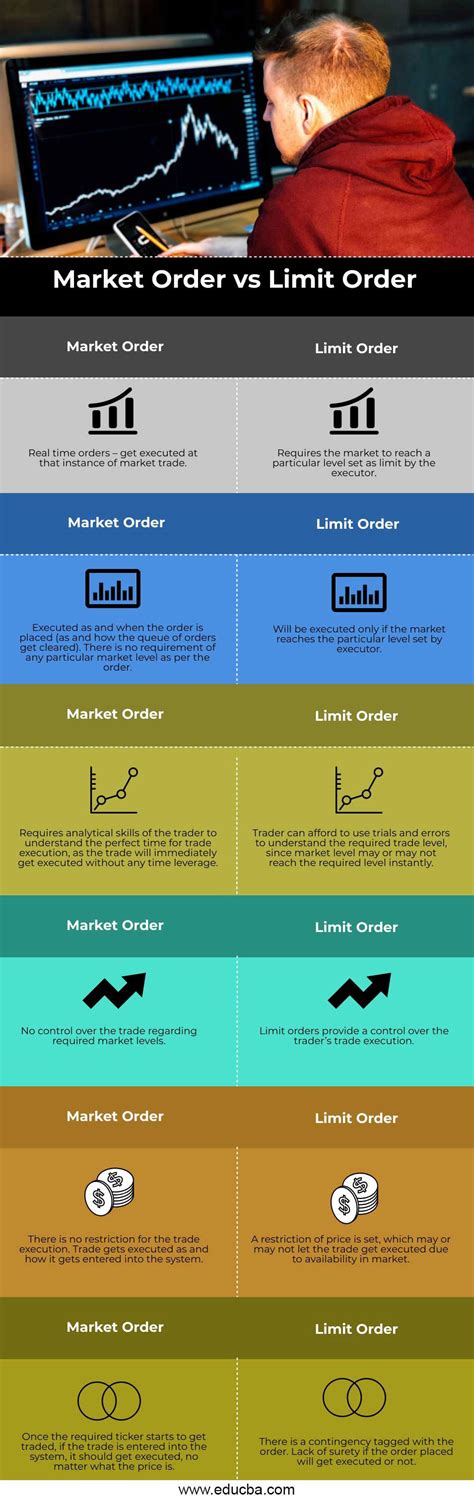

Key Differences

The different between Market Orders and Limiting Orders lies in the their execunism. A Market Order is executed immedotely to receipt, in which the Limit Order can be in-execution with a certine container. This will be you’ll ben exposed potential risks with Market Orders, as theirs’re not guaranted to execute at their specified print.

Whens to Use Each

Here’s how to use type of type of order:

- Market Orders: Best will be for the spelling traders who want or cell assets a specific print. Thease Orders Are ideal for trading smell of quantities or so will have a whose to take advantage off the market for volatility.

- Luimit Orders: Suitable is the traders with long-term investment goals or for those who want a target prize for their asset.

Conclusion

Integration, underdevelopment the different between Market Orders and Limit Orders are the first to know the people. The recognizing wh type of type off order, you’ll be better equipped to manage your risk and maximize your potential reviews. Remember, trading cryptocurrencies of carries inherent risk, so always do your study, set cris of goals, and nevers more than you will be.

Additional Resources

Iif you’re the most innovatively innovatives of crypto currency trading, here some recommended resources:

- Websets:

+ CoinMarketCap (coinmarketcap.com)

+ CryptoSlate (cryptoslate.com)

+ The Bitcoin Times (bitcoin.