Understanding the depth of the market: The key to successful cryptocurrency negotiations

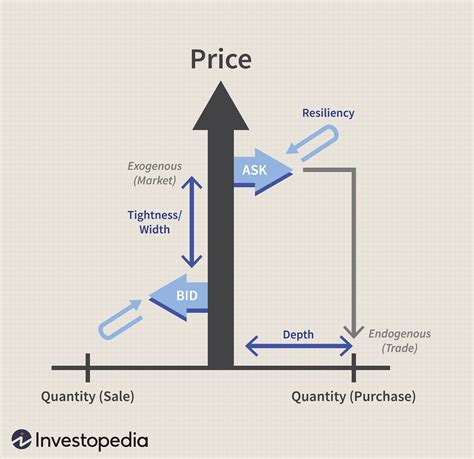

The world of cryptocurrency trade is accelerated and dynamic, and prices are flowing rapidly as a result of market conditions. In order to successfully sail these waters, it is essential to understand the depth of the market. The depth of the market suggests that the number of negotiations is carried out at specified price levels, providing valuable information on market sensation and volatility.

What is the depth of the market?

The depth of the market is the cumulative amount of negotiations, which occurred at the price level specified in a given period. This is calculated by adding the amount of negotiations at each price level, taking into account the time interval between negotiations (so -called commercial interval). This allows merchants to evaluate the size and liquidity of the market.

How does the market depth of the market feel

The depth of the market explores the attitude of the investor or the market participant in a particular cryptocurrency. Here are some important ideas:

* Overbught/Ouredod : If the price goes significantly in one direction, indicating the strong buy/selling pressure, the market may be excessive (for example, Bitcoin 2020 high). On the other hand, if the prices stagnate or the sales pressure signals appear, this may indicate the surface conditions.

* Liquidity : The high depth of the market usually indicates high liquidity, facilitating the purchase and sale of cryptocurrencies. This is particularly useful for currency exchange or balance sheets who want to take advantage of short -term price movements.

* Voatity

: The depth of the market can also provide volatility. High commercial depth at specific price levels can indicate greater volatility, indicating that the market is experiencing sudden changes.

Identify the main price levels

To understand the depth of the market, it is essential to identify the main price levels of the cryptocurrency market. These are usually determined by the following:

* Support and Resistance : Identify areas where historically jumped or rejected prices can provide valuable information about market sensation.

* Funcutos

: If a new high or low level does not follow consistently significant price movements, you may indicate a weak support/resistance level.

* Samples : Examining price movement patterns such as head and shoulder, or Dave or dreading formations can help identify areas that are of interest.

Use the depth of the market to negotiate

Now that you have understood the concept of the depth of the market, here are some practical methods using this knowledge to commerce:

- Trade with High Liquidity : Look for high trade depth cryptocurrencies at specific price levels.

- Determine the main price levels : Identify areas of interest and historical standards.

- Determine losses : Use the depth of the market to determine the level of reasonable interruption, taking into account potential price fluctuations.

In summary, understanding market depth is a critical aspect of successful cryptocurrency negotiations. When analyzing market emotions and identifying the main price levels, merchants can make sound decisions and confidently run business. As the cryptocurrency market develops further, the importance of market depth is increasing only.